Stock probability calculator

This program was inspired by lecture 10 on Linear Algebra by Professor Gilbert Strang available at. Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product.

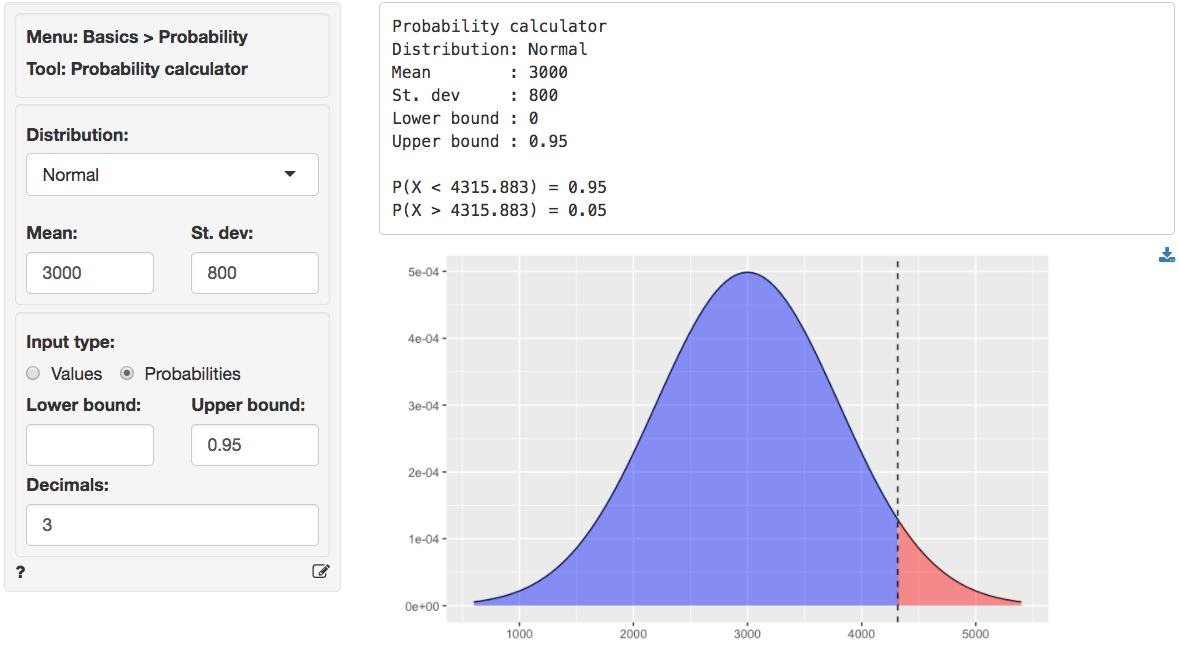

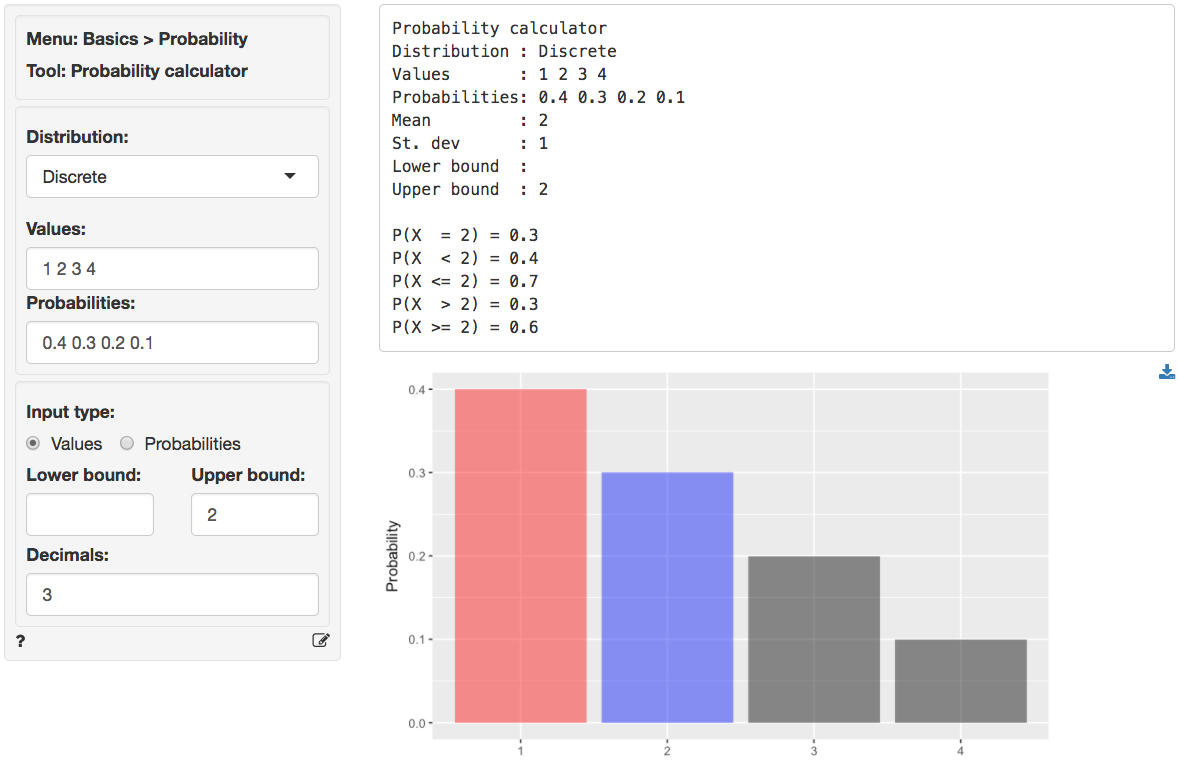

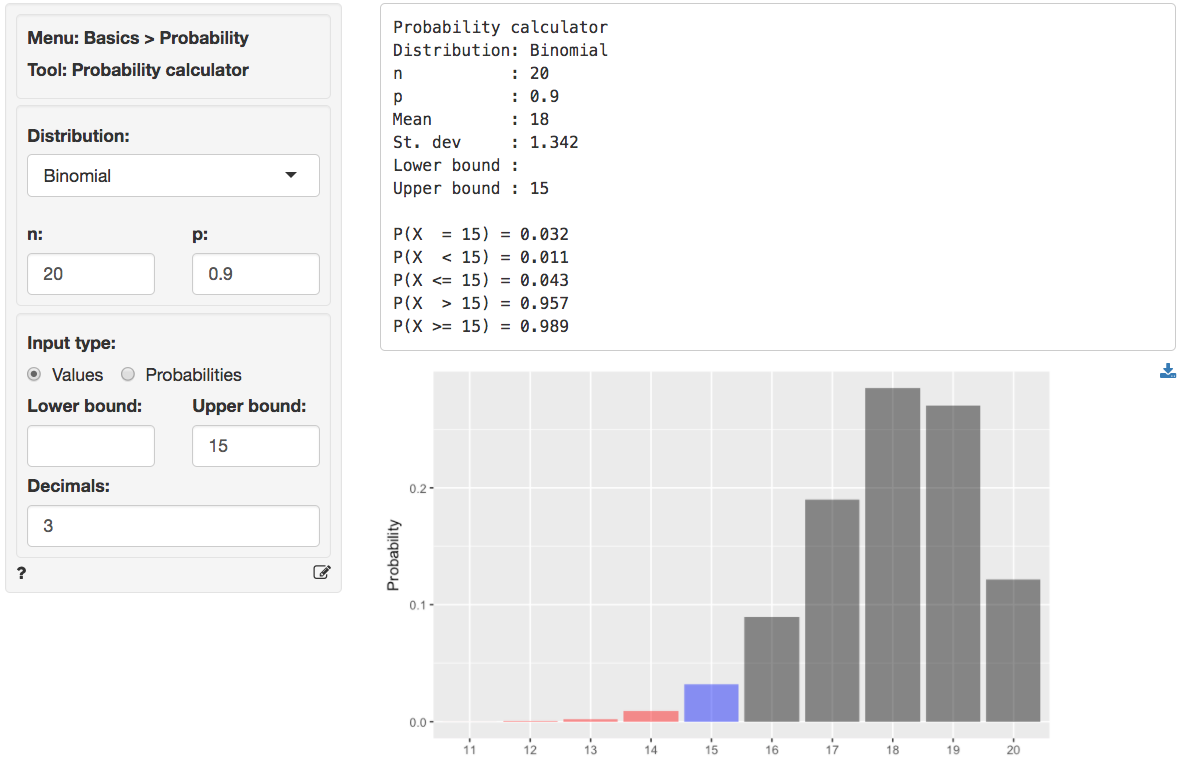

Basics Probability Probability Calculator

Cash Secured Put calculator addedCSP Calculator.

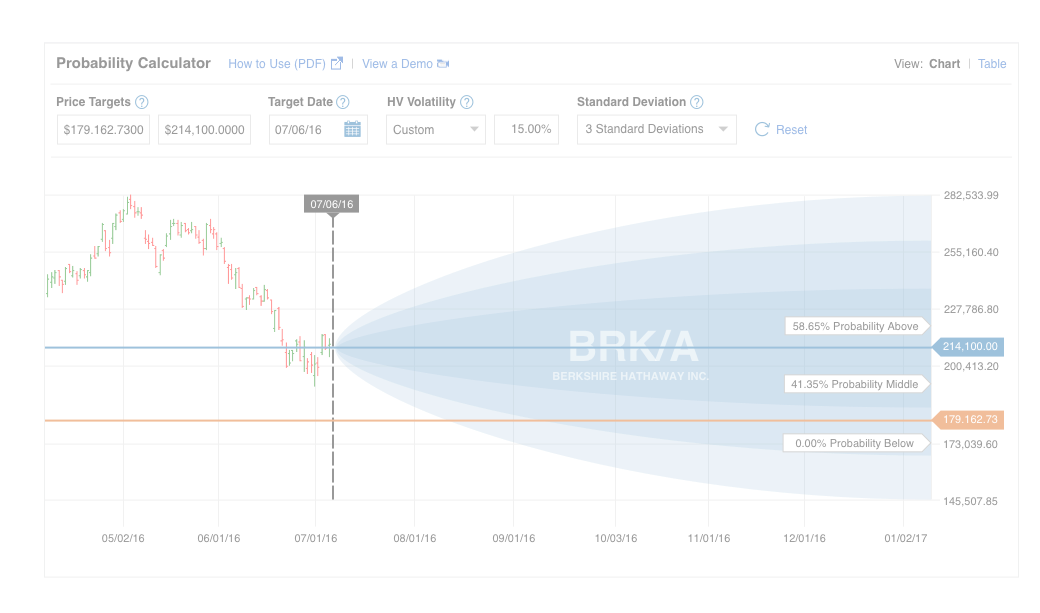

. The results show both closing probabilities ie at end of period and the probabilities of the boundary prices ever being exceeded ie the probability that the boundary prices will be exceeded at any time. The standard normal distribution function that is used to do this is as follows. The calculator is an online statistics probability tool featured to generate the complete work with step by step calculation for the any given valid input values.

In a z-table the zone under the probability density function is presented for each value of the z-score. Then a linear regression is conducted and the estimated slope of the regression model using the returns of the company as the dependent variable and the returns of the market as the independent variable will be the beta we are. Find the best spreads and short options Our Option Finder tool now supports selecting long or short options and debit or credit spreadsTry it out.

55 probability of rise over next five days NTAP stock rose 26 over a five-day trading period ending 8262022 compared to the broader market SP500 which was down 19. Salary Income Tax. Data may be loaded for a symbol that has options or data may be entered manually.

You can use this interquartile range calculator to determine the interquartile range of a set of numbers including the first quartile third quartile and median. Computes the probability of a stock price exceeding or falling between upper and lower boundary prices. Apple Inc Balance sheet Explanation.

But aside from using a lottery calculator you should also steer clear of the many lotto strategy myths that have been going around for centuries. How to use the Interquartile Range Calculator. Treasury Stock Method Calculation of Diluted Shares.

The Probability Calculator evaluates option prices to compute the theoretical probability of future stock prices. Use this calculator to find the probability of independent complement mutual or non-mutual union intersection condition probability of events. Support for Canadian MX options Read more.

Poor Mans Covered Call calculator addedPMCC Calculator. 22 likelihood event. Related Probability Calculator.

For instance lets say that a company has 100000 common shares outstanding and 200000 in net income in the last twelve months. Technical Analysis of Stocks. Of course take some time to learn the complexity of computing the probability to enrich your mind.

To enter data for a specific symbol enter a symbol in the text box labeled Symbol then click Load Data for Symbol. 1 Enter each of the numbers in your set separated by a comma eg 19115977 space eg 1 9 11 59 77 or line break. You need to provide the returns and NOT the actual stock values in order for the calculations to be correct.

Best Months to Buy or Sell Stocks. NA T Column Space Calculator. 12 Enrich your knowledge of probability and combinatorics and how they work in tandem.

While Stock A has a higher probability of an average return closer to 7 Stock B can potentially provide a significantly larger return or loss. The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your choice of either the Black-Scholes or Binomial Tree pricing modelThe binomial model is most appropriate to use if the buyer can exercise the option contract before expiration ie American style options. The conditional probability work generated by this calculator may helpful for beginners or grade school students to understand how the input parameters values are being used in.

These are only a few examples of how one might use standard deviation but many more exist. The formula for a stock turnover ratio can be derived by using the following steps. Stock price probability calculator.

It is also possible to employ an integral to determine the area under the curve. IV is now based on the stocks market. Generally calculating standard deviation is valuable any time it is.

We can then subtract the 5000 shares repurchased from the 10000 new securities created to arrive at 5000 shares as the net dilution ie the number of new shares post-repurchase.

Stock Out Probability Calculator Calculator Academy

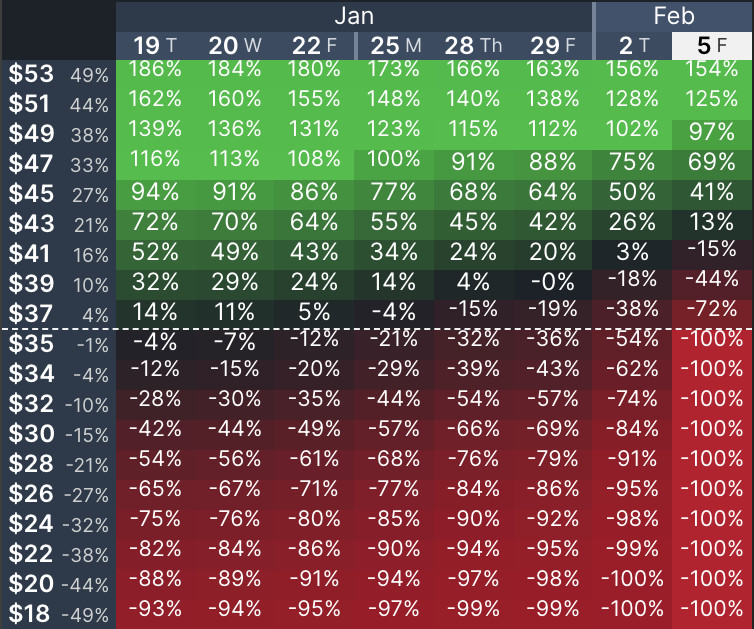

Using Optionstrat S Options Profit Calculator Optionstrat

Probability Of A Successful Option Trade

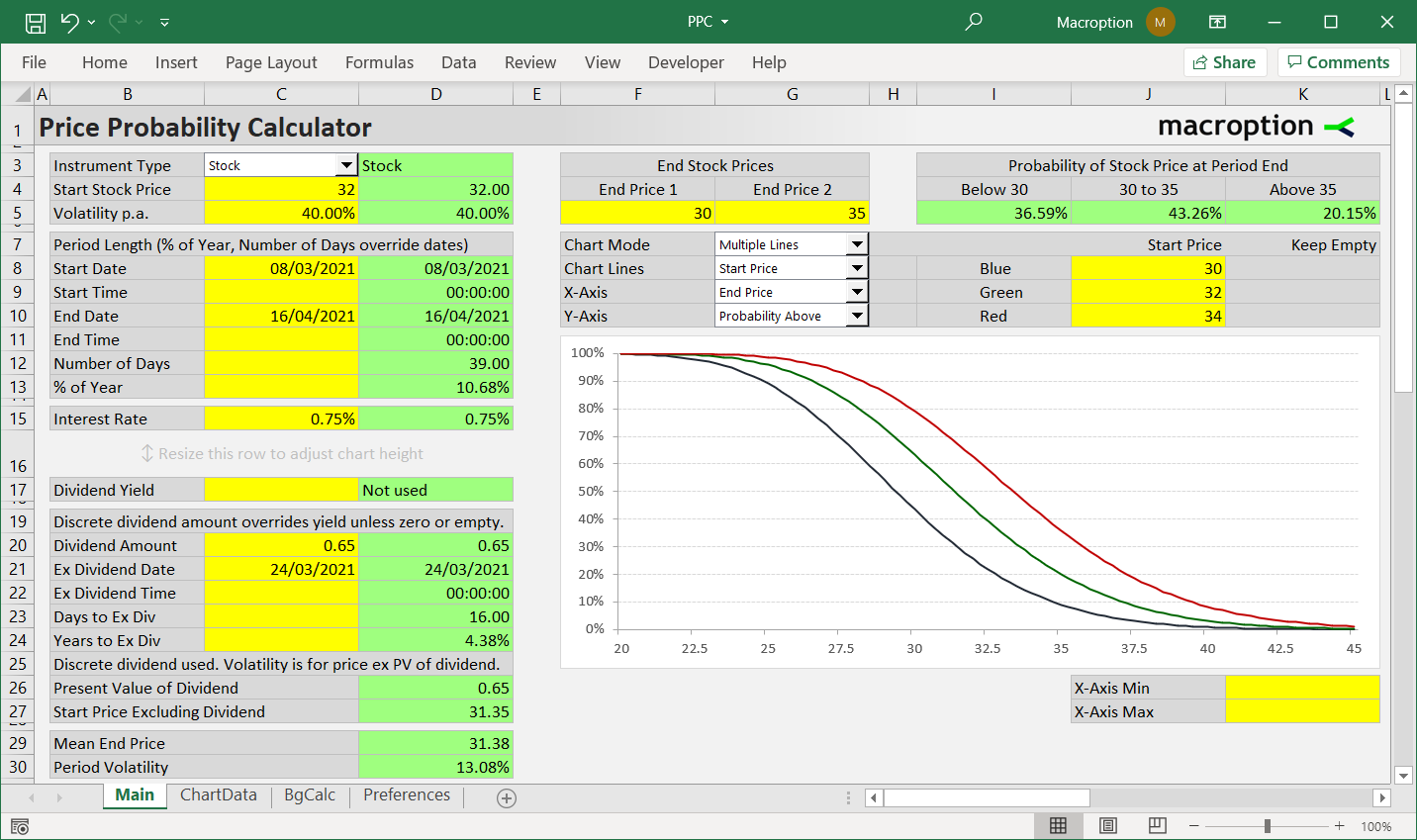

Price Probability Calculator Macroption

Options Probability Calculator Youtube

Trade Probability Calculator

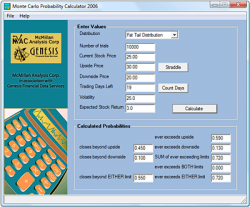

The Probability Calculator Monte Carlo Simulation Option Strategist

Basics Probability Probability Calculator

Using The Probability Calculator Tradespoon

The Probability Calculator Monte Carlo Simulation Option Strategist

Ivolatility Com Basic And Advanced Options Calculator

How To Calculate Probability In Excel Excelchat Excelchat

Probability Calculator Fidelity Investments

Basics Probability Probability Calculator

Ivolatility Com Services Tools Analysis Services Basic Live Calculator Live Calculator

How To Use Probability Calculators With Options Trades Financialtrading Com

Options Trading Trade Probability Calculator